Medicare Enrollment: When, How and Where

Getting Medicare at the right time can provide peace of mind, security and savings.

Medicare Enrollment Periods

Most people sign up for Medicare when they turn 65. This is the best time to enroll because you’ll avoid paying late enrollment penalties.

Important Reminders

- To continue enrollment in the Group Medicare Advantage plan, you must continue to stay enrolled in Medicare Part A and Part B and pay any applicable Part B premiums including your Part B or Part D IRMAA (income-related monthly adjustment amount), if applicable.

- You must continue to reside in our service area, which is the 50 United States, DC and Puerto Rico.

- You can only be in one Medicare Advantage plan at a time. Medicare will automatically terminate you from your CareFirst Group Medicare Advantage Plan if you enroll in any other Medicare Advantage plan or standalone Part D prescription drug plan.

- Employers may require their retirees to enroll in Medicare by their 65th birthday month to enroll in their retiree group plan and employers will have specific open enrollment periods to sign up for their Medicare Advantage Group Plan. Please check with your employer.

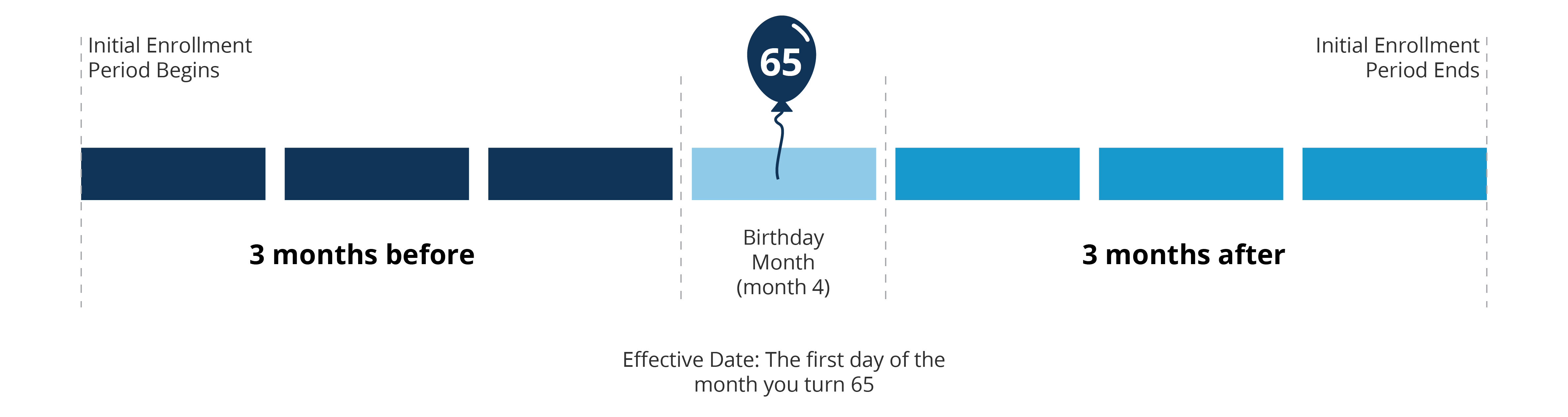

Initial Enrollment Period

The initial enrollment period for Original Medicare and prescription drug (Part D) coverage is a 7-month window:

- The 3 months before your 65th birthday

- The month of your birthday, and

- The 3 months after

To sign up for a prescription drug plan, you first need to be enrolled in Parts A or B. If you don’t sign up for Part D during this period, you may have to pay a late enrollment penalty.

General Enrollment Period

If you missed your initial enrollment period, you can enroll in Original Medicare during the general enrollment period. However, there may be a penalty for late enrollment.

- January 1 to March 31, every year

- Your coverage begins on July 1 of the same year

After signing up for Original Medicare, you can enroll in a prescription drug plan between

Special Enrollment Period

There are certain events that may qualify you for a special enrollment period for Original Medicare. For instance:

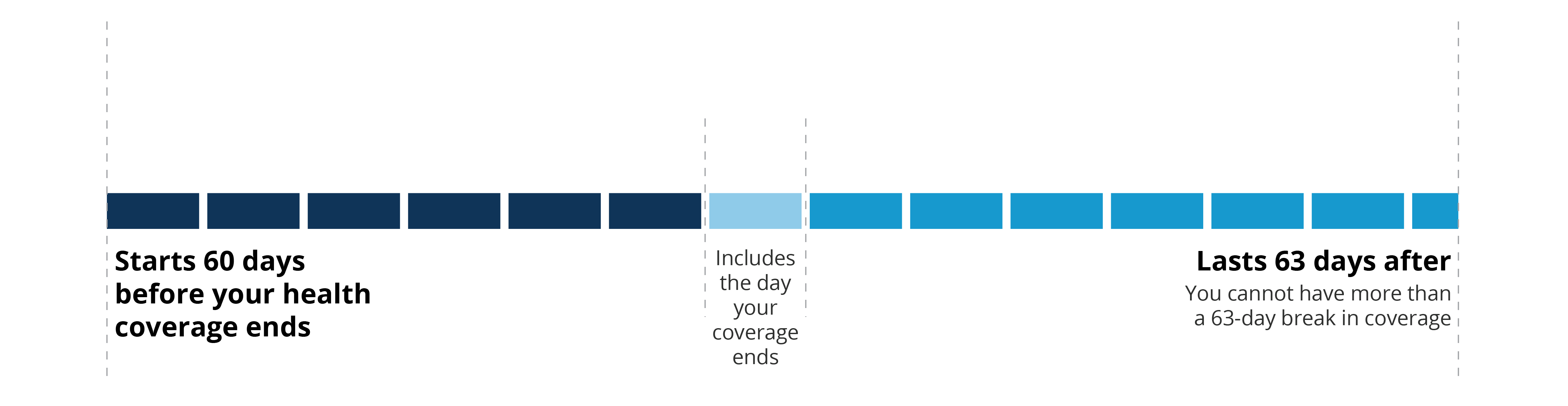

If you work past 65 or continue health coverage with your employer. This period lasts 8 months after you stop working or when your coverage ends (whichever comes first).

If you lose your employer retiree health coverage. In this case, your special enrollment period lasts 6 months after your coverage ends.

In either case, you have 2 months to enroll in a prescription drug plan after the month your employer health coverage ends.

Learn more about other qualifying events at medicare.gov.

Explore More of the Basics

It depends.

If you’re already receiving Social Security or Railroad Retirement Board benefits, you’ll automatically get Original Medicare when you turn 65. Otherwise, you must manually enroll in Medicare through the Social Security Administration.

- Online: ssa.gov

- Call: 800-772-1213 or (TYY) 800-325-0778, Monday-Friday, 8 a.m. to 5:30 p.m.

- In-Person: Visit your local Social Security office

If you work past 65, or continue coverage with an employer retiree health plan, you can still sign up for Part A during your initial enrollment to avoid a late enrollment penalty. You can also delay enrolling in Medicare Part B to avoid having to pay the monthly premium.

To explore your Medicare options, contact your Benefits Administrator. A few items to discuss include:

- How will your current insurance work with Medicare?

- Will the current insurance cover most medical costs?

- What are the options after you or your spouse retires?

When you become eligible for Medicare, you will need to enroll in both Medicare Part A and Part B to get full benefits from your retiree coverage.